- Using loan funds wisely can turn a personal loan into a powerful financial tool.

- When managed thoughtfully, borrowed money can help you bridge financial gaps, achieve important goals, and strengthen your overall financial position.

- At BrightSide Loans, we focus not just on lending, but on helping borrowers make informed, confident decisions.

- This guide explores practical ways to use loan funds wisely so that borrowing works for you, not against you.

- The Golden Rule of Borrowing Before exploring specific uses, it is important to begin with one guiding principle: borrow only what you need and have a clear plan to repay it.

Using loan funds wisely can turn a personal loan into a powerful financial tool. When managed thoughtfully, borrowed money can help you bridge financial gaps, achieve important goals, and strengthen your overall financial position.

At BrightSide Loans, we focus not just on lending, but on helping borrowers make informed, confident decisions. This guide explores practical ways to use loan funds wisely so that borrowing works for you, not against you.

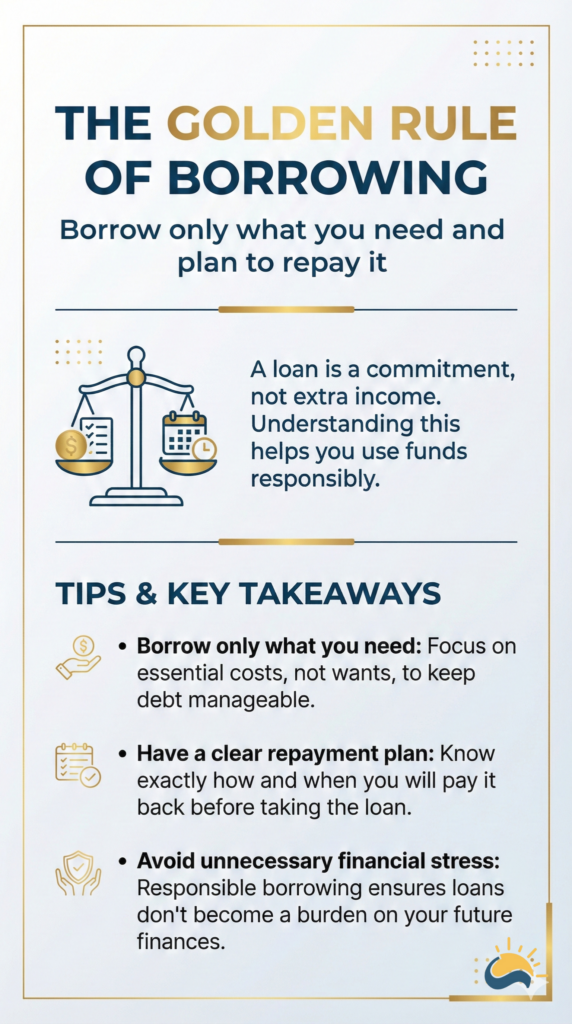

The Golden Rule of Borrowing

Before exploring specific uses, it is important to begin with one guiding principle: borrow only what you need and have a clear plan to repay it.

A loan is a commitment, not extra income. When borrowers understand this from the start, they are more likely to use funds responsibly and avoid unnecessary financial stress. Careful planning ensures that borrowing supports long-term stability rather than creating future pressure.

Consolidating High-Interest Debt

One of the smartest ways to use a personal loan is to consolidate high-interest debt. Managing multiple credit cards or short-term loans can be overwhelming, especially when interest rates are high.

A debt consolidation loan helps by:

- Combining several debts into one loan

- Reducing the overall interest rate

- Replacing multiple due dates with a single monthly payment

As a result, borrowers often find it easier to stay organized and pay off debt faster.

Investing in Home Improvements

Using loan funds for home improvements can be a strategic financial decision. Since a home is a long-term asset, improvements often provide lasting value.

Loan funds are commonly used for:

- Essential repairs such as plumbing or roofing

- Energy-efficient upgrades

- Kitchen or bathroom renovations

When planned carefully, these improvements can enhance daily comfort while also increasing property value over time.

Managing Unexpected Emergencies

Life is unpredictable. Medical expenses, car repairs, or appliance breakdowns often arrive without warning—and not all emergencies can be covered by savings.

In such cases, a personal loan can provide quick access to funds without relying on high-interest credit cards or payday loans. A loan offers breathing room during stressful moments, allowing you to manage emergencies without disturbing long-term financial goals.

The Importance of a Repayment Plan

Spending loan funds wisely is only part of responsible borrowing. Repayment planning is equally important.

Before applying, borrowers should:

- Review their monthly budget

- Ensure the EMI fits comfortably within income

- Plan for consistent, on-time payments

Additionally, setting up auto-payments and making extra payments when possible can:

- Support a positive credit history

- Reduce interest costs

- Shorten the loan term

Separating Needs from Wants

Although personal loans are flexible, they should be used thoughtfully. Borrowers benefit most when loans are used for meaningful needs rather than impulse spending.

Before borrowing, it helps to ask:

- Is this expense essential?

- Will it improve my financial stability?

- Can it be saved for instead?

Clear decision-making helps ensure loan funds deliver long-term value.

Loan Inquiry Form

Frequently Asked Questions

- Will taking a personal loan affect my credit score?

Applying for a loan may cause a small, temporary dip in your score. However, making consistent on-time payments can strengthen your credit profile over time.

2. Is debt consolidation always a good idea?

Debt consolidation can be effective if the loan offers a lower interest rate and borrowers avoid taking on new debt after consolidation.

3. Can a personal loan be used for emergencies?

Yes. Personal loans are commonly used to manage unexpected expenses when savings are insufficient.

Final Thoughts

A personal loan can be a helpful financial stepping stone when used responsibly. Whether the goal is to consolidate debt, improve a home, or handle unexpected costs, smart borrowing begins with planning and discipline.

With a transparent process and borrower-focused approach, BrightSide Loans supports individuals who want to move forward with confidence. When used wisely, loan funds can help build a balanced, stable, and brighter financial future.