Choosing a loan is not just about how much money you borrow. Just as important is how long you take to repay it. This is known as the loan term, and selecting the right one can make a big difference to your monthly budget, overall interest, and financial peace of mind.

Whether you’re planning a major purchase, consolidating debt, or covering an unexpected expense, understanding loan terms can help you make a smarter and more confident decision.

What Is a Loan Term?

A loan term is the length of time you have to repay your loan, including interest. Loan terms usually range from short-term options like 12 months to longer terms such as 5, 10, or even 30 years, depending on the type of loan.

In general:

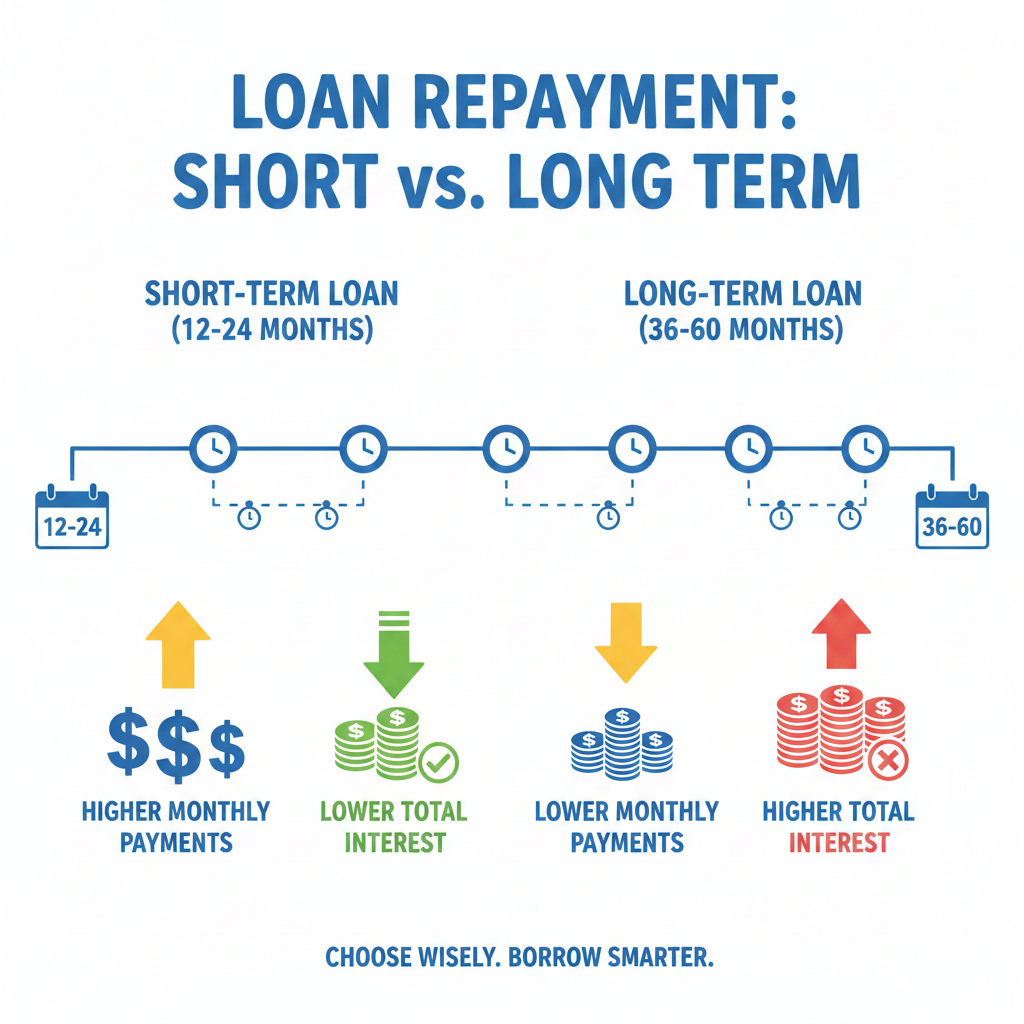

- Shorter loan terms mean higher monthly payments but less interest overall.

- Longer loan terms offer lower monthly payments but result in higher total interest paid over time.

Choosing the right balance is key.

Start With Your Monthly Budget

Before selecting a loan term, take a close look at your monthly income and expenses. Ask yourself:

- How much can I comfortably afford each month?

- Will this payment still work if my expenses increase?

- Do I have room for savings and emergencies?

A loan should fit into your life, not stretch your finances too thin. While lower monthly payments may seem appealing, it’s important to ensure the term aligns with your long-term goals.

Understand the Trade-Off Between Time and Interest

One of the biggest factors in choosing a loan term is interest cost. Longer loan terms reduce monthly pressure, but they increase the total amount you repay.

For example:

- A shorter term helps you become debt-free faster.

- A longer term provides flexibility but costs more over time.

Therefore, if your budget allows it, a shorter loan term may save you money in the long run. However, if cash flow is tight, a longer term can provide breathing room.

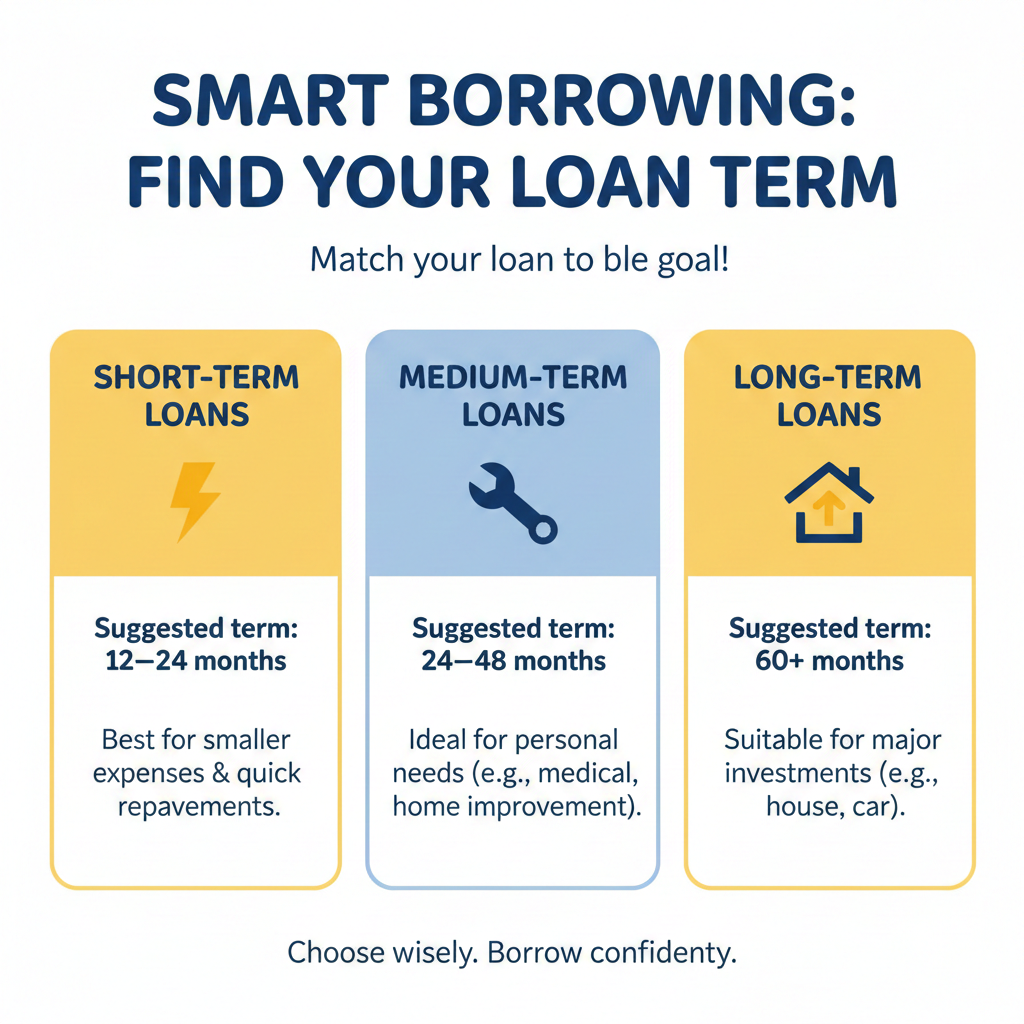

Match the Loan Term to the Purpose

Different goals call for different loan terms. As a rule of thumb:

- Short-term loans work well for smaller expenses or quick repayments.

- Medium-term loans are ideal for personal needs like medical bills or home improvements.

- Long-term loans suit major investments where spreading the cost makes sense.

Choosing a term that matches the purpose of the loan helps keep your finances balanced.

Consider Your Future Financial Plans

Your current situation matters, but so does your future. Think about upcoming changes such as:

- Career growth or job changes

- Family expenses

- Other financial goals

A loan term that works today should still feel manageable tomorrow. If your income is likely to increase, a shorter term may be more realistic. On the other hand, if your future expenses are uncertain, flexibility is important.

Avoid Common Loan Term Mistakes

Many borrowers choose a loan term based only on the monthly payment. While this is understandable, it can be misleading. Always review:

- Total interest paid

- Length of financial commitment

- Early repayment options

Being informed helps you avoid unnecessary financial stress later.

Get Expert Guidance Before You Decide

Choosing the right loan term does not have to be confusing. With the right support, you can find an option that fits both your budget and your goals.

And remember, you don’t have to figure it out alone. The Bright Side Loans team is here to help you at every stage. If you’re ready to explore your options, give them a call at +1-888-70-80-90-7. It’s toll-free, easy to remember, and connects you directly to someone who can guide you.